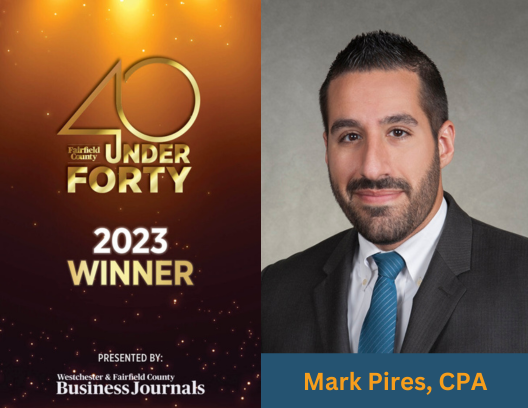

(June 14, 2022 – Shelton, Conn.) Mark Pires, CPA and senior manager at CironeFriedberg, LLP, joins the prestigious list of accomplished awardees of the 2023 Fairfield County 40 Under Forty award. The award recipients were announced and celebrated on June 14 at The Point at Norwalk Cove, in Norwalk, Conn.

Mark completed his Bachelor of Science in Accounting and Business Administration at Southern Connecticut State University. He is a Certified Public Accountant in Connecticut and has been practicing in his profession of accounting for 15 years.

In 2021, Mark joined the regional firm CironeFriedberg, LLP, as Senior Manager. He provides audit and tax services to a variety of industries including public utility, manufacturing and not-for-profit organizations as well as employee benefit plans, multistate and multinational corporations, compliance and auditing procedures for single audit engagements and individual and corporate income tax return preparation.

Mark serves as Vice President of the Board of Directors at Bridge House, Inc., a non-profit organization committed to improving the quality of life for adults living with persistent mental illness. In addition, Mark is an active member in a number of professional organizations, including the Connecticut Society of Certified Public Accountants, the American Institute of Certified Public Accountants, and the Greater Danbury, New Haven, and Greater Valley (Shelton) Chambers of Commerce.

Outside of work, Mark and his wife, Diane, are the busy and happy parents of a six-year-old daughter, a four-year-old son, and a baby on the way.

Tony Cirone, CironeFriedberg’s managing partner, says “We are very proud of Mark and happy to celebrate this well-deserved award.” He adds, “Mark’s leadership is an inspiration to his peers and his commitment to our clients is unparalleled.”

About CironeFriedberg

CironeFriedberg is a leading regional CPA firm serving middle market, closely held and family-owned businesses, high-net-worth individuals, and not-for-profit organizations in Fairfield and New Haven Counties, in Connecticut, and the neighboring New York counties of Duchess, Putnam, and Westchester. The firm provides a full range of tax, audit and accounting, and business advisory services from three offices in Bethel, Shelton and Stamford Connecticut. Learn more at https://cironefriedberg.com.

CironeFriedberg is a member of CPAmerica. CPAmerica is a member of Crowe Global, providing our firm access to a top-10 global accounting network with over 200 independent accounting and advisory firms in more than 130 countries.

CironeFriedberg.com

203.366.5876 | info@CironeFriedberg.com