By Tammy Maguire, Principal, CironeFriedberg, LLP

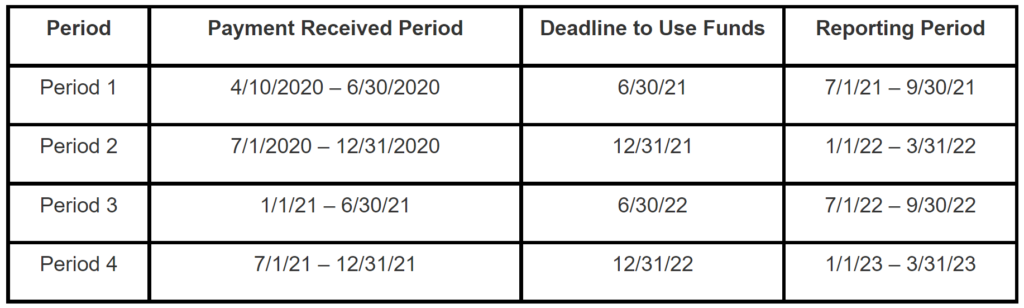

On June 11th, the U.S. Department of Health and Human Services (HHS) issued guidance on reporting for the Provider Relief Fund (PRF). Reporting was delayed from the original February 15, 2021, filing deadline and now includes 4 filing deadlines based upon when funding was received as opposed to requiring payments to be used by June 30, 2021. Any recipient who received $10,000 in aggregate will be subject to reporting requirements. The time frame to complete the reporting is also extended from 30 days to 90 days.

The payment received date is the date in which the funds were available to the provider (ACH date or check cashed date). When determining expenses, the provider must follow their normal basis of accounting (cash vs accrual). A provider may report expenses that were incurred (or paid) prior to the date funds were received as long as they were to prevent, prepare for, and respond to COVID-19.

Prior to completing the reporting, recipients will need to register on the PRF Reporting Portal at https://prfreporting.hrsa.gov/s/.

Once a recipient is ready to report their use of funds, data will be reported in the following order:

- Interest earned on PRF payments

- Applicable only if funds were held in an interest-bearing account

- Any interest earned will be added to the funding received to determine the total funding that should be used

- Other assistance received – during the period of availability (timeframe in which PRF payments were made). Reporting will be by quarter.

- Department of Treasury and/or Small Business Administration

- Includes Paycheck Protection Program and Economic Injury Disaster Loan

- Federal Emergency Management Agency Programs

- HHS CARES Act Testing

- Local, State and Tribal Government Assistance

- Business Insurance

- Claims paid by insurance companies to cover losses related to business interruption

- Other

- Any other federal/state COVID-19-related assistance

- Department of Treasury and/or Small Business Administration

- Use of Nursing Home Infection Control Distribution Payments (if applicable)

- Report on infection control expenses paid with Nursing Home Infection Control Distribution Payments – including interest

- General and Other Targeted Distribution Payments

- Not reimbursed from another source

- General and Administrative

- Mortgage/Rent

- Insurance – property, malpractice, business insurance

- Personnel – limited to Executive Level II salary of $197,300 in 2020 and $199,300 in 2021. The cap is exclusive of fringe benefits and indirect costs.

- Fringe Benefits – can include hazard pay, travel reimbursement, employee health insurance

- Lease payments – new equipment or software leases (not purchased and will be returned to the owners)

- Utilities – includes cleaning and additional third party vendor services not included in personnel

- Other general and administrative – expenses not previously captured but considered a part of general and administrative

- Healthcare related

- Supplies – used for the purpose of infection control such as personal protective equipment, hand sanitizer, and supplies for COVID-19 testing

- Equipment – purchase of equipment for infection control such as HVAC systems or sanitizing equipment

- IT – used to preserve infection control such as telehealth, increased bandwidth, technology to connect families and patients remotely, teleworking to support remote workforce

- Facilities – purchase permanent or temporary structure to retrofit facilities to accommodate revised patient treatment practice and support infection control

- Other – any other expenses not previously noted and purchased for infection control

- Net unreimbursed expenses attributable to COVID-19

- Reporting will be broken down by quarter and split between:

- General and administrative

- Healthcare related

- Reporting will be broken down by quarter and split between:

- Lost revenues

- Submit revenue by payer mix and by quarter during the period of availability

- 3 options to determine lost revenues (calculated by quarter)

- Option 1 – difference between actual patient care revenue vs 2019

- Option 2 – difference between budgeted (prior to March 27, 2020) and actual patient care revenue

- Option 3 – calculated by an reasonable method to estimate revenue

If you need assistance or have any questions on the information in this article, please call your CironeFriedberg professional. You can reach us by phone at (203) 798-2721 (Bethel) or (203) 366-5876 (Shelton), or email us at info@cironefriedberg.com.