MyCTSavings is a new retirement savings program sponsored by the State of Connecticut’s Retirement Security Authority designed to help the 600,000-plus private-sector employees who do not have an employer-sponsored retirement savings plan. It offers some of the best features of employer plans and IRAs but does not pose an administrative burden to businesses.

With MyCTSavings, employers can offer a retirement savings plan benefit, and employees can protect their financial future with a convenient savings plan. Participation in the program is completely voluntary.

Employees are able to set aside a portion of their paycheck into an individual retirement account that they fully control through online access. The plan is portable, so it goes with the employee if they change jobs or move out of state.

Employer Eligibility

- All Connecticut employers with five or more employees whom they pay more than $5,000 in a calendar year are required by law to join MyCTSavings.

- Employees must be at least 19 years of age to be enrolled in the program.

- There are no employer fees.

- Employers are neither required nor permitted to contribute to the program.

- Signing up is quick, easy, and free.

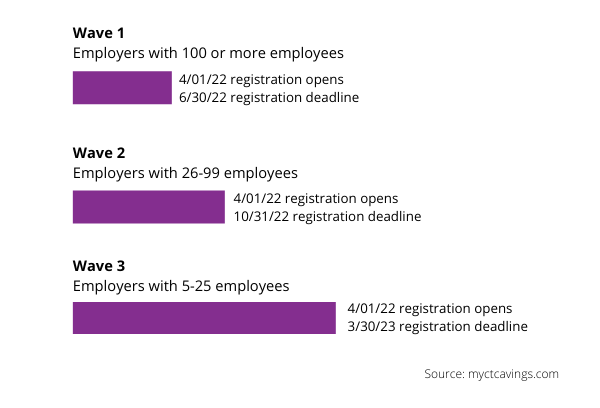

- There are registration deadlines. (See the chart here.)

Employer Registration

Signing up for MyCTSavings is quick, easy, and free. Once you sign up, MyCTSavings will notify you when it’s time for your business to register and provide an access code. At that time, you will need:

- Your Federal Employer Identification Number (EIN)

- MyCTSavings Access Code from your notification

Using Your Payroll Administrator

Employers that have registered with MyCTSavings may choose to use their current payroll administrator to provide information to facilitate the program. Vestwell is the retirement administration partner MyCTSavings uses. The employer portal integrates seamlessly with many existing payroll providers (e.g., ADP, Paychex, and more).

If an employer is not currently using a payroll system, they can easily enter and upload their payroll information. After initial setup, a business can assign administrative rights to additional users to facilitate the process.

You will need the following to set up an employer MyCTSavings account:

- Your company’s EIN and the unique Access Code from your registration notification.

- Your payroll provider’s name (if you use one) and your company’s payroll schedule(s).

- Your company’s bank information for payments.

- Your latest employee roster and accompanying personal information (employee name, contact info, date of birth, SSN, etc.). Payroll providers can compile employee information in advance using a template available on the MyCTSavings site.

Employers and employees can learn all about the program by visiting https://myctsavings.com/.

If you need assistance or have any questions on the information in this article, please call your CironeFriedberg professional. You can reach us by phone at (203) 798-2721 (Bethel), (203) 366-5876 (Shelton), or (203) 359-1100 (Stamford) or email us at info@cironefriedberg.com.