Insights and News

CironeFriedberg is a leading CPA firm serving middle market, privately held and family owned businesses and high-net-worth individuals. Our experienced staff provides a full range of tax, audit and accounting, and business advisory services in Connecticut and neighboring Dutchess, Putnam, and Westchester counties in New York.

Exploring Agreed-Upon Procedures

In the dynamic landscape of financial reporting and auditing, accounting professionals are constantly seeking innovative ways to provide assurance and insights to their clients. One approach that has gained prominence in recent years is Agreed-Upon Procedures (AUP) accounting engagements. AUP engagements offer a flexible and tailored approach to address specific financial and non-financial reporting issues, making them a valuable tool […]

Read MoreA Strategic Solution for Businesses: Outsourcing Accounting Services

In today’s fast-paced business landscape, organizations must maintain precise financial records, navigate complex regulations, and make informed financial decisions to thrive. However, many businesses, particularly smaller ones, find it challenging to handle their accounting tasks in-house, especially in this tight labor market. Outsourcing accounting services has emerged as a strategic solution, offering a wide array of benefits that can significantly […]

Read MoreIRS Stops Processing of Employee Retention Credit (ERC) Claims Through 2023

There has been growing concern over Employee Retention Credit (ERC) claims filed by unqualified business owner applicants fueled by a surge in scammers encouraging ineligible business owners to file claims. Honest business owners are plagued with aggressive broadcast advertising, direct mail solicitations, and online promotions for this credit. Many of these ads misrepresent who can qualify for the ERC, which […]

Read MoreAnnouncing Staff Promotions

CironeFriedberg, LLP, is pleased to announce the recent promotions of Lucas Ullrich, CPA, to Supervisor and Hoang Nguyen and Adam Ross to Senior Accountants. Lucas Ullrich, CPA, received his Master of Science in Accounting from Post University and his Bachelor of Science in Business Administration with a concentration in Accounting from Southern Connecticut State University. He specializes in audit and […]

Read MoreNavigating the Complexities of the New Lease Standard under ASC 842

By now all organizations should have implemented Accounting Standards Codification 842, Leases (ASC 842), into their financial reporting practices under generally accepted accounting principles in the United States of America. The Financial Accounting Standards Board (FASB) introduced ASC 842 to address the longstanding concern of lease accounting transparency. ASC 842 aims to provide a comprehensive framework for reporting leases, mandating […]

Read MoreConnecticut’s 2023 Tax-free Week

Each year, starting the third Sunday in August, for one week in Connecticut, no state sales tax is charged for the purchase of certain clothing and footwear costing less than $100. The week of sales tax suspension starts Sunday and ends Saturday. There are a few things to keep in mind when considering a purchase. For example, the tax exclusion […]

Read MoreChanges to Charities and Registrations in Connecticut

The Connecticut Solicitation of Charitable Funds Act requires all organizations that solicit contributions for charitable purposes to register with the Department of Consumer Protection or claim a qualified exemption from filing. There is good news for charitable organizations whose gross income is in excess of $500,000 but less than $1,000,000, whereby these organizations will not be required to have audited […]

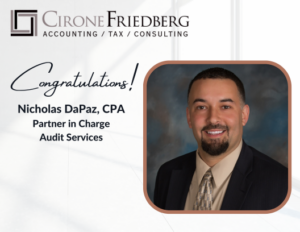

Read MoreCironeFriedberg Announces Audit Partner Promotion

CironeFriedberg, LLP, is pleased to announce the promotion of Nicholas DaPaz, CPA, to Partner in Charge of Audit services for the Firm. Nick joined CironeFriedberg in 2019 as a Manager and was quickly promoted to Senior Manager before becoming Partner in 2021. Nick has over 20 years of experience providing audit and tax services for employee benefit plans and multistate […]

Read MoreCironeFriedberg Announces Tax Partner Promotion

CironeFriedberg, LLP, is pleased to announce the promotion of David C. Moseman, CPA, to Partner in Charge of Tax services for the Firm. David joined CironeFriedberg in 2005. He has nearly 30 years of experience providing tax and consulting services to clients. He specializes in estate and trust taxation, partnership taxation and tax planning for privately held businesses and high-net-worth […]

Read More