Insights and News

CironeFriedberg is a leading CPA firm serving middle market, privately held and family owned businesses and high-net-worth individuals. Our experienced staff provides a full range of tax, audit and accounting, and business advisory services in Connecticut and neighboring Dutchess, Putnam, and Westchester counties in New York.

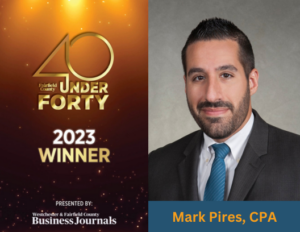

CironeFriedberg’s Mark Pires Wins 40 Under Forty Award

(June 14, 2022 – Shelton, Conn.) Mark Pires, CPA and senior manager at CironeFriedberg, LLP, joins the prestigious list of accomplished awardees of the 2023 Fairfield County 40 Under Forty award. The award recipients were announced and celebrated on June 14 at The Point at Norwalk Cove, in Norwalk, Conn. Mark completed his Bachelor of Science in Accounting and Business […]

Read MoreImportant Tax Deadlines for 2023

Tax deadlines occur throughout the year. Here are a few important deadlines to mark on your calendar. Work with your tax CPA to prepare for each accordingly. Estimated Tax Payments Those who are self-employed or do not have taxes withheld from other sources of taxable income must pay taxes owed by making estimated tax payments. Payment For Income Earned in […]

Read MoreAmortizing Research and Experimentation Costs

Beginning in 2022, amendments made by the Tax Cuts and Jobs Act require taxpayers to amortize research and experimentation expenditures (R&E) over five years, or 15 years for foreign expenditures. Prior to 2022, a taxpayer could elect to deduct research and experimental expenses, amortize them over a period of at least 60 months, or capitalize them to the related property. […]

Read MoreChanges to the Electric Vehicle Tax Credit

Are you eligible for a tax credit for your electric vehicle? You might be if you bought a new, qualified, plug-in electric vehicle (EV) in 2022 or earlier. Changes to the electric vehicle tax credit were made under the Inflation Reduction Act. There are new income limits for taxpayers to obtain the tax credit effective on 1/1/23. Federal adjusted gross […]

Read MoreThe Importance of Tax Planning

The purpose of tax planning before your fiscal year end is to minimize your tax liability. An experienced tax CPA will scrutinize your revenue, expenses and business processes to ensure that you are taking maximum advantage of all applicable opportunities to minimize your tax liability and take advantage of all tax savings programs. That is why tax planning is as […]

Read MoreImportant January and February Tax Deadlines

As you head into a new year, mark these dates on your calendar. There are tax deadlines for both individuals and businesses early in the year. Important 2023 Tax Deadlines and Dates for Individual Filers Individual Filers are employees, retirees, self-employed individuals, independent contractors, and gig or contract workers. Be sure to work closely with your CPA to understand how […]

Read MoreWhat To Know About Fringe Benefits and Taxes

You can generally deduct the amount you pay your employees for the services they perform. The pay may be in cash, property or services. It may include wages, salaries, bonuses, commissions or other noncash compensation such as vacation allowances and fringe benefits. A fringe benefit is a form of pay for the performance of services beyond your employees’ normal rate […]

Read MoreFunding Marital Gift and Credit Shelter Trusts

Baby boomers are inheriting their parents’ wealth, and their children are receiving funds transferred through a variety of trusts established under their parents’ estates. You may find yourself responsible for managing the wealth transfer process. In the past, banks and trust companies were tasked with dealing with estates, but these days, individuals are taking on the jobs of executors and […]

Read More