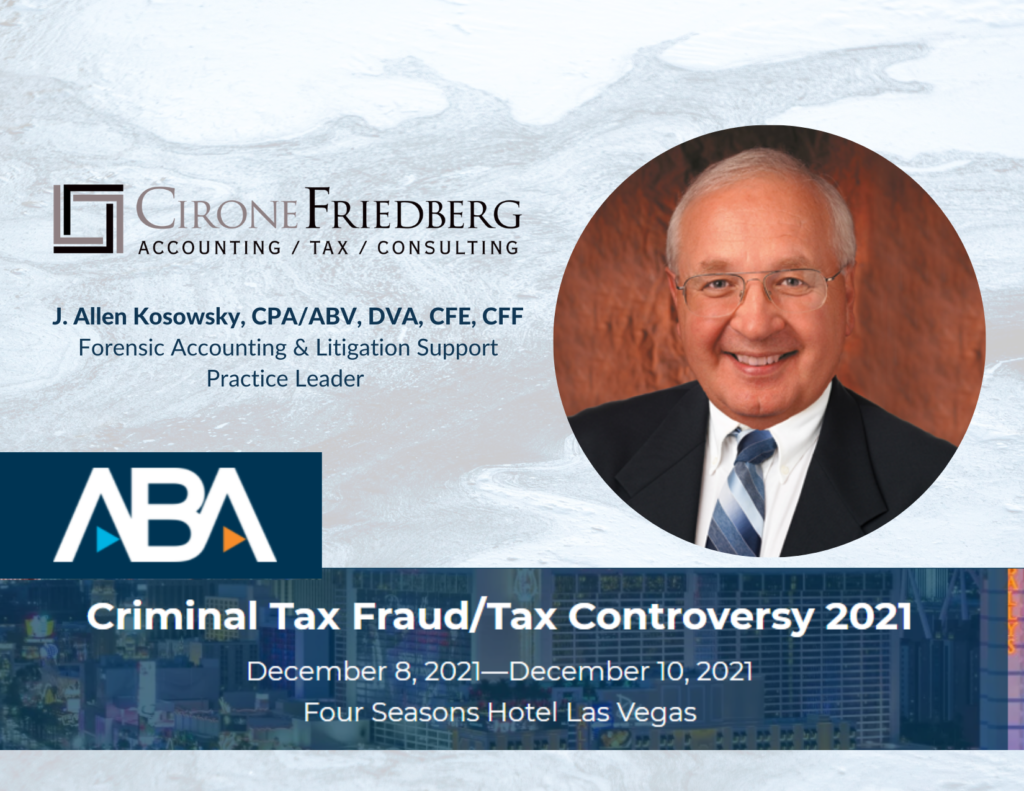

J. Allen Kosowsky, CPA and forensic accounting and litigation support practice leader at CironeFriedberg, LLP, will join the distinguished panel of experts at the 38th Annual American Bar Association (ABA) Institute on Criminal Tax Fraud and the 11th Annual National Institute on Tax Controversy, in Las Vegas, on December 8th.

Kosowsky has over 40 years of experience in business valuation, intellectual property valuation, and financial advisory, and provides expert investigative and litigation support to law firms. His many professional certifications and credentials include Certified Public Accountant (CPA), Certified Valuation Analyst (CVA), Accredited in Business Valuation Certification (ABV), Certified Fraud Examiner (CFE), and Certified in Financial Forensics (CFF).

Joining a panel with three others, Kosowsky will address the topic “Sensitive Audits: Ethical Considerations,” which explores issues including the ethical responsibilities accountants face when clients cannot answer questions posed by the IRS and assessing risks of criminal referral.

Tony Cirone, CironeFriedberg’s managing partner, says “Allen has an impressive amount of experience in forensic accounting and litigation support, and we are very pleased to see him share his expertise at this conference.” Commenting on the 2020 merger of Kosowsky’s practice into the Firm, he adds “Allen’s expertise combined with the growth of our valuation, forensic, and litigation support practice allow us to continue to expand our services by meeting the complex demand for this highly specialized group of services.”

At this annual ABA gathering of the criminal tax controversy and criminal tax defense bar, high-level government representatives, judges, corporate counsel, and private practitioners come together to share and learn about important information in areas of tax controversy, tax litigation, and criminal tax prosecutions and defense. Click here for information on this event.

About CironeFriedberg

CironeFriedberg is a leading regional CPA firm serving middle market, closely held and family-owned businesses, high-net-worth individuals and not-for-profit organizations in Fairfield and New Haven Counties, in Connecticut, and the neighboring New York counties of Duchess, Putnam, and Westchester. The growing firm provides a full range of tax, audit and accounting, and business advisory services from three offices in Danbury, Shelton and Stamford Connecticut. Learn more about us online.